The Definitive Guide to Certified Cpa

Wiki Article

The Facts About Accounting Fresno Uncovered

Table of ContentsHow Accounting Fresno can Save You Time, Stress, and Money.The smart Trick of Fresno Cpa That Nobody is DiscussingAbout Certified CpaAll about Certified Accountant

Getty Images/ sturti Contracting out accountancy solutions can free up your time, prevent mistakes and also even decrease your tax costs. Do you need a bookkeeper or a certified public accounting professional (CERTIFIED PUBLIC ACCOUNTANT)?

Tiny business proprietors additionally assess their tax burden and also remain abreast of upcoming modifications to stay clear of paying more than needed. Generate financial declarations, consisting of the equilibrium sheet, profit as well as loss (P&L), money circulation, and revenue declarations.

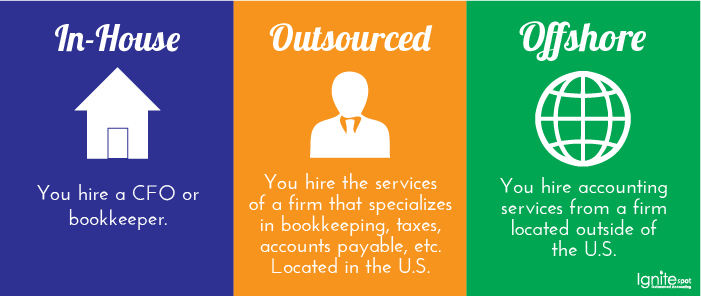

Track job hours, compute wages, withhold tax obligations, problem checks to staff members and also ensure accuracy. Accountancy solutions might additionally consist of making payroll tax repayments. Furthermore, you can work with professionals to create and also establish your accounting system, give financial preparation recommendations as well as clarify financial declarations. You can outsource primary financial officer (CFO) solutions, such as sequence planning as well as oversight of mergers as well as purchases.

Some Known Details About Fresno Cpa

Usually, little company owners outsource tax obligation services initially and include pay-roll help as their company grows., 68% of respondents utilize an external tax specialist or accounting professional to prepare their firm's taxes.Produce a listing of processes and also responsibilities, as well as highlight those that you're willing to contract out. Next off, it's time to locate the ideal accountancy provider. Since you have an idea of what kind of accounting solutions you require, the concern is, who should you work with to offer them? While an accountant manages data entry, a Certified public accountant can talk on your behalf to the Internal revenue service and also provide financial guidance.

Prior to deciding, consider these inquiries: Do you want a neighborhood bookkeeping expert, or are you comfy functioning essentially? Does your company call for sector knowledge to execute accountancy tasks? Should your outsourced solutions incorporate with existing bookkeeping devices? Do you want to contract out personnels (HUMAN RESOURCES) and also pay-roll to the same vendor? Are you looking for year-round aid or end-of-year tax obligation administration services? accounting consultancy services Can a specialist complete the job, or do you require a group of specialists? Do you require a mobile application or on-line portal to oversee your accountancy solutions? Carbon monoxide aims to bring you inspiration from leading highly regarded professionals.

The Greatest Guide To Certified Cpa

Specialist organization suggestions, news, and trends, supplied weekly By subscribing you consent to the carbon monoxide Personal Privacy Policy. You can pull out anytime. Released November 30, 2021.

In the USA, the certified public accountant designation is controlled by specific state boards of book-keeping. To end up being a CERTIFIED PUBLIC ACCOUNTANT, a specific usually requires to finish a specific number of college training course credit ratings in bookkeeping as well as business-related topics, obtain a particular quantity of practical experience in the area, and pass the Attire State-licensed accountant Evaluation (Certified Public Accountant Examination).

They might function in various sectors and also organizations, consisting of public accountancy companies, personal businesses, government agencies, and nonprofit companies. Some Certified public accountants specialize in a specific area of accountancy, such as tax obligation, audit, or monitoring accounting. Administration or managerial accounting professionals use financial details to aid organizations make educated business decisions. They are liable for providing monetary data and evaluation to supervisors and also developing and carrying out monetary systems and also controls.

The Basic Principles Of Fresno Cpa

They may be associated with activities such as preparing monetary reports, establishing budget plans, assessing financial information, and also click for more developing financial models to assist managers make informed choices about the company's operations and also future instructions. In comparison to public accounting professionals, that typically deal with a variety of customers and concentrate on exterior monetary coverage, administration accounting professionals work mainly with the monetary information of a single organization.

A Chartered Accounting Professional (CA) is an expert accounting professional that has actually fulfilled specific education and also experience needs as well as has actually been granted a professional accreditation by a recognized bookkeeping body. Chartered Accountants are frequently thought about among the greatest level of expert accounting professionals, as well as the CA designation is recognized and respected worldwide. To end up being a Chartered Accountant, an individual normally requires to finish a particular degree of education and learning in accountancy and also relevant topics, gain a specific amount of practical experience in the area, as well as pass an expert qualification evaluation.

Numerous various expert accounting bodies give the CA designation, including the Institute of Chartered Accountants in England as well as Wales (ICAEW), the Institute of Chartered Accountants of Scotland (ICAS), and the Institute of Chartered Accountants in Ireland (ICAI). The needs as well as procedures for coming to be a Chartered Accounting professional differ relying on the specific professional body (accountants).

Report this wiki page